Tracking Your Investments: 10 Minutes Will Save You Thousands

In case you haven't read the post about tracking your money for free with Mint, check it out here.

My favorite feature by far though is the portfolio asset allocation tool. In one nice chart you can see clearly how all of your investment accounts are allocated across stocks, bonds, alternatives, etc. You can click U.S. stocks for instance and drill down to what percentage are large cap growth vs. small cap value. It's a very useful set of capabilities for informational purposes and even more so once you've set a desired asset allocation for your investments (coming soon in another post!). If you go the route of firing/hot hiring an investment advisor, it replaces a big part of what they "do" for exactly $0!

My favorite feature by far though is the portfolio asset allocation tool. In one nice chart you can see clearly how all of your investment accounts are allocated across stocks, bonds, alternatives, etc. You can click U.S. stocks for instance and drill down to what percentage are large cap growth vs. small cap value. It's a very useful set of capabilities for informational purposes and even more so once you've set a desired asset allocation for your investments (coming soon in another post!). If you go the route of firing/hot hiring an investment advisor, it replaces a big part of what they "do" for exactly $0!

Okay, now that you've surely signed up with Mint, you might be wondering what other tools are going to help you keep everything in order in a 21st century kind of way. In particular, Mint will track your investment balances and transactions well, but it doesn't delve too much into your investments themselves.

So, with that in mind, I wanted to share some thoughts about one of my favorite free tools out there for tracking your investments in more detail, Personal Capital.

Much like Mint, Personal Capital links to your bank and investment accounts and pulls in the account balances for them in a convenient combined interface available on your PC, tablet, and mobile to make it easy to see everything under one roof. Like Mint, Personal Capital can show you all of your funds in a number of formats, including historical graphs and reports so you can see all of your great progress over time!

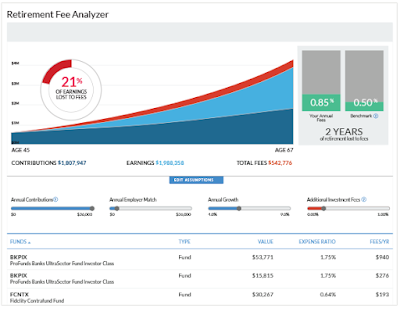

Where things get interesting is when you actually start to look at your investment accounts in more detail using things like the retirement fee analyzer, which looks at your 401(k), IRAs, and any other supported retirement account types to show you how the fees will impact your return. I couldn't believe how much I was paying in my 401(k) and I made some simple changes that will save me tens of thousands of dollars in the coming years. That alone made it well worth the minimal time it took to get set up.

My favorite feature by far though is the portfolio asset allocation tool. In one nice chart you can see clearly how all of your investment accounts are allocated across stocks, bonds, alternatives, etc. You can click U.S. stocks for instance and drill down to what percentage are large cap growth vs. small cap value. It's a very useful set of capabilities for informational purposes and even more so once you've set a desired asset allocation for your investments (coming soon in another post!). If you go the route of firing/hot hiring an investment advisor, it replaces a big part of what they "do" for exactly $0!

My favorite feature by far though is the portfolio asset allocation tool. In one nice chart you can see clearly how all of your investment accounts are allocated across stocks, bonds, alternatives, etc. You can click U.S. stocks for instance and drill down to what percentage are large cap growth vs. small cap value. It's a very useful set of capabilities for informational purposes and even more so once you've set a desired asset allocation for your investments (coming soon in another post!). If you go the route of firing/hot hiring an investment advisor, it replaces a big part of what they "do" for exactly $0!

The Personal Capital website and app are completely free to access, but here's the rub. They make their money by enrolling people in their investment advisory service, which has a fee starting at 0.89% of assets under management. It doesn't sounds like a lot but if you invested $10,000/yr for the next 30 years (adjusted for 2%/yr inflation), it would cost you a whopping $119,000 to use their service! I'll cover advisor costs another time, but I'd strongly advise a thorough calculation of advisory costs before you take the leap to something like this. That's a topic for another post!

When you sign up a scheduling rep will reach out via cell phone and possibly email to set up a free session with one of their advisors to introduce their offering. You don't have to take that call, but I did out of curiosity and it was efficient, friendly and informative. I learned some things and I'm glad I did it. I ended up not enrolling in their service because it seemed expensive and I wasn't sure I agreed with their suggested approach to allocation. They do still call me occasionally, especially if I glance at the"investment checkup" section of their site, but I blocked their phone number so it doesn't ring through to my cell anymore. Problem solved.

The biggest benefit Personal Capital provided for me was actually the opposite of what they're trying to do all along. Using their app convinced me to fire my own financial advisor by showing me how much I was paying in fees for something I could easily do myself. In other words, this free app has always saved me a ton of money and is going to save me much much more in avoided fees. as I keep on stacking.

Anyway, I absolutely love their tool and use it regularly to review my allocation whenever I need to rebalance my portfolio. They have some sweet budgeting features too, but I still prefer Mint for that, so I'm happy to just use this as my free investment advisor app. Take 10 minutes to sign up on their site. You definitely won't regret it.

Keep Stacking,

BS

Comments

Post a Comment