How to Build An Emergency Fund

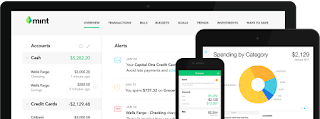

What's an Emergency Fund? Everyone knows the word 'emergency', but in the context of personal finance it's worth understanding what we mean by an emergency. A financial emergency could be the loss of a job, unforeseen medical bills, car or home repairs, or anything else that could happen to you or your property that you'd want to have some cash on hand for. If you're investing efficiently, it's best to only have the cash to cover your standard expenses and a bit extra that you might really need in a pinch if a few things went south at the same time. The rest of it should be growing on it's own while you keep adding more to the pot. How Much Should I Set Aside? This is going to be somewhat unique to you and your situation. Here's the approach I would take: 1. Figure out your expenses. By now you're probably familiar with Mint as a great tool to organize and track all of your finances and expenses automatically. Figure out how much you...